If you’re old enough to remember Lucy and Ricky sleeping in separate beds, chances are you’ve seen your share of market ups and downs. You’ve experienced enough volatile market conditions to know the only constant is the state of flux. The part of the financial equation that has changed over the years is, well… you.

When you were decades away from retirement, an occasional downturn was no cause for alarm. There was always time to recover. Now, the math is different. With less time to rebound and the absence of a regular salary, plummeting stocks can take a huge toll financially and emotionally. The good news is a strong, long-term financial plan, built for good times and bad, should keep the retirement margaritas flowing without interruption.

As you consider creating a viable retirement plan, here are a few ideas for minimizing the impact of a down market on your retirement portfolio.

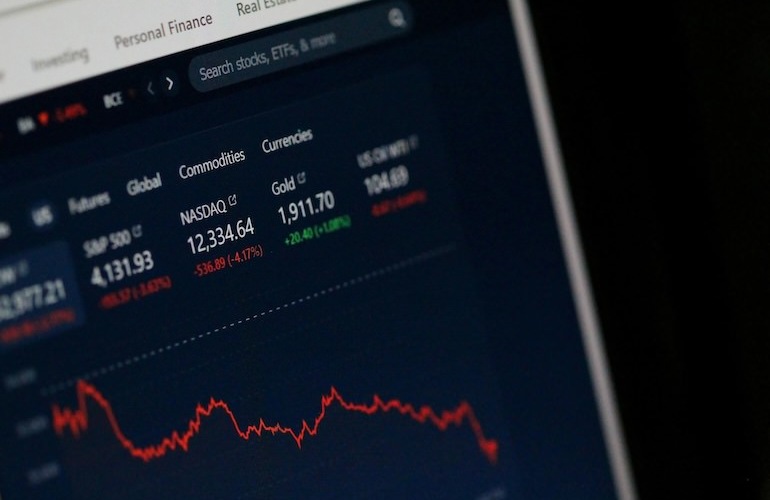

Study the Numbers

The key to continued solvency is knowing exactly how much money you can withdraw from your portfolio annually and still have enough in place to sustain a long, happy retirement. According to online experts, a common practice is to withdraw 4% from your portfolio in the first year and then adjust that amount for inflation every year after that. Of course, that is only a general rule. You can calculate a more precise figure by taking advantage of online tools or creating a plan with a financial consultant. Both can estimate the likelihood of your portfolio withstanding the test of time. Certainly, market changes will affect those predictions. If it is ascertained your savings have an 80% or higher chance of covering your retirement, it may be that all you need to survive a downturn are small adjustments. If that number falls below 75%, you may have to sit down and rework the plan.

Strike a New Balance

If market turbulence has left your portfolio out of whack with your long-term goals, consider raising cash by rebalancing. Simply put, according to the experts, that involves selling assets that have risen in value and may now be overrepresented and buying those that have decreased in value. The idea is to return your allocation ratio to its original balance. It may also be a good time to unload some assets that no longer match your profile.

Understand Tax Breaks

Consult your financial expert to be aware of any tax breaks you may be entitled to. For example, if you have any assets in taxable non-retirement accounts that have fallen in value, you may be able to take advantage of a process called tax-loss harvesting whereby you can use those losses to help reduce your taxes by up to $3000.

It’s All About Needs, Wants and Wishes

You know what they say: If wishes were fishes, we’d all swim in riches. As you sit down to outline a viable budget plan, it may be helpful to prioritize expenses – with those wishes on the expendable list. Sigh. First on the list are your essentials – like food, housing, health care, insurance and taxes. Then itemize wants like dining out, entertainment, and travel. Last, but not least, it’s okay to write down your wishes, knowing that, if things get tight, they may be unfulfilled. Creating a budget under any circumstances is about as much fun as a migraine, and even less so as you slash those wants and wishes. But consider this: The key to life - and budgets - is low expectation. If you are realistic, you will not be disappointed. But when and if things pick up, you may just be pleasantly surprised every now and then.

Rightsize into an Overture Community

You can’t control the health of the economy, but you can experience the ultimate retirement lifestyle at one of Overture’s premier senior living apartment communities. Call it the one stop shop for your retirement wants, needs and wishes. Book a tour today and become part of an active enthusiastic community of kindred spirits who get you and understand exactly where you are coming from financially, socially and emotionally.

Talk about bang for your retirement buck.

The content provided is for informational purposes only. The information provided should not be considered as professional financial advice or a recommendation to buy, sell, or hold any securities or financial instruments. Readers should consult with a licensed financial advisor before trading stocks and/or making any investment decisions.